This essay is the last in a three-part symposium on housing and family. Read the first here and second here.

We have to face facts: the middle class is increasingly threatened by the cost-of-living crisis that has its roots in severely unaffordable housing. Any agenda that seeks to help families must make it easier to afford a home.

The housing affordability crisis has been widely studied and documented. In its 2019 report Under Pressure: The Squeezed Middle-Class, the Organization for Economic Cooperation and Development (OECD) found “that the middle class faces ever rising costs relative to incomes and that its survival is threatened.” Further, the OECD cites housing as the “main driver,” especially the costs of ownership rather than rents. We see this across the developed world, including here in the United States.

It wasn’t that long ago that the median-income household could afford the median-priced house in virtually all major US housing markets (defined as metropolitan areas with a population over one million). Now, those days are gone, probably for good. For nineteen years, the Demographia International Housing Affordability, which I now author, has been illustrating the substantial differences in housing affordability between major housing markets. And the trends are not looking good.

Start your day with Public Discourse

Sign up and get our daily essays sent straight to your inbox.An Overview of Housing Affordability

Any discussion of housing affordability requires comparing house prices to incomes. An expensive home on paper can actually be relatively affordable if there are high enough incomes to match, whereas what seems like a cheaper house in a poor area could actually be unaffordable.

In our work, the Demographia series uses a price-to-income ratio called the median multiple to rate housing affordability (Table 1). This is calculated by taking the median house price in a given market and dividing it by that market’s median household income. By doing this, we can compare affordability at the housing market level, such as San Francisco and Indianapolis, or over time a given housing market, such as Denver between 2005 and 2020.

Using this metric, we can see that from World War II through at least 1969, housing was affordable (3.0 median multiple or less) throughout the United States, including now notoriously unaffordable California. Among today’s 56 major metropolitan areas, all were rated as “affordable” in 1969, with the exception of Honolulu (3.4) and New York (3.2).

Over the next half century, the picture changed dramatically. Last year (2022), the least affordable major market in the United States was Honolulu, with a median multiple of 11.8. Its median multiple had gone up three and a half times what it was in the late 1960s. To put that in perspective, the median house price in the Honolulu area is nearly 12 times the median household income.

But Honolulu isn’t the only area where a home is out of reach for the typical buyer. Honolulu was followed closely by California markets: San José (11.5), Los Angeles (11.3), San Francisco (10.7), and San Diego (9.4). All of these markets saw prices had at least tripled relative to incomes compared to 1969.

Outside of California and Hawaii, the least affordable markets were in Miami (8.5), New York (7.1), Denver (7.1), Seattle (6.9), Las Vegas (6.9), and Portland and Boston (6.7). At the other end of the scale, the most affordable markets were Pittsburgh (3.1), Rochester (3.2), Cleveland and St. Louis (3.5).

To put the point more sharply: living in the New York market in 1969 was more affordable for a typical household than the St. Louis market today. If we wonder why families feel increasingly behind the eight ball, these dismal trends certainly play a major role. At the same time, these housing affordability differences attest to the fact that the housing crisis is focused in only about a dozen markets out of the 56 major ones.

Understanding the Causes

Economists have found that increasing regulations on land use have been a driving factor in housing becoming unaffordable. The 2020 Economic Report of the President shows that excessive housing regulation has driven house prices up by 100 percent in the Los Angeles and San Diego markets and 150 percent more in the San Francisco Bay area (San Francisco and San José markets).

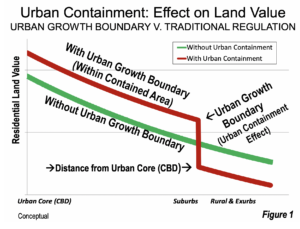

Urban containment seeks to stop urban expansion (urban sprawl), which occurs organically as populations increase. It is probably the most restrictive land-use regulation. Urban containment uses “urban growth boundaries” (UGBs) and greenbelt policies that restrict development on agriculture or wild land, making it illegal or especially costly to build new housing subdivisions on or beyond the urban fringe. Urban containment seeks to increase housing and other urban development without allowing the supply of land to increase. Indeed, prominent urban planners note that urban containment “is intended” to increase land costs within the UGBs. Urban containment succeeded at this, but that was no victory for middle-income households aspiring to home ownership.

In 2019, the last year before the pandemic demand shock, all of the severely unaffordable US housing markets in Demographia Housing Affordability were subject to urban containment. No markets without urban containment were ranked as severely unaffordable. Therefore, it should be no surprise that land and related regulatory costs now account for most of the cost of living differences between US metropolitan areas.

Proponents claim that urban containment preserves open space, reduces traffic congestion, preserves agricultural land, and decreases public costs. On the other hand, opponents of urban containment say that the related housing affordability and standard of living losses far outweigh any of the claimed benefits.

Urban containment has created sellers’ land markets, which are incapable of accommodating the demand.

The impact of containment policies on land values is illustrated in the figure below. Land values are forced up dramatically throughout the contained area

Urban containment drove up land prices so much that builders were no longer able to supply housing to much of the middle class. There must be a sufficient supply of competitively priced homes to maintain housing affordability. But urban containment has created sellers’ land markets, which are incapable of accommodating the demand.

In sum, the skyrocketing value of land inflates housing prices. Harvard’s Ed Glaeser and Penn-Wharton’s Joseph Gyourko show that land has traditionally comprised 20 percent of the cost of new housing. Yet in the San Francisco metropolitan area (larger geographically than the state of Delaware), they estimate that land values inflated the final price to 2.84 times the expected price. The land component of the total housing cost was nearly $500,000—ten times the expected $50,000.

Densification

Some state and local governments have turned to densification (creating dense urban populations through high-rise apartments and condos) in order to improve housing affordability in the late 2010s. However, the problem is that containment policies have created a “floor value” for land throughout the urban area (as the figure above illustrates), which raises the price of virtually all residential development, without regard to its density. Zoning reforms at the municipal level cannot trump the influence of metropolitan or regional urban containment policy.

Additionally, there is considerable disagreement among economists about how much, if at all, densification can improve housing affordability; the actual experience suggests a rather negative view. For example, the Vancouver, BC, housing market has had decades of densification and continually worsening housing affordability. The core city of Vancouver has effectively eliminated single-family zoning and massively densified, increasing its population density 72 percent between 1961 and 2021 (within virtually the same urban footprint). No other large high-income world core city in the world has equaled this. Suburban Vancouver has also densified.

Overwhelmingly, therefore, evidence suggests that densification has not improved affordability. Indeed, the Vancouver housing market deteriorated from a 3.9 median multiple in 1970 to 12.0 in 2022, a tripling of house prices relative to incomes. Not surprising, there is an exodus of domestic migrants leaving such markets for places that are more affordable. University of British Columbia planner Patrick Condon concluded “There is a problem beyond restrictive zoning. No amount of opening zoning or allowing for development will cause prices to go down.”

Reorienting Priorities

The intensity of the housing affordability crisis suggests that we must reorient current policies on land use and focus on the most fundamental objective: what’s good for people. Paul Cheshire, Max Nathan, and Henry Overman of the London School of Economics have suggest that “the ultimate objective of urban policy is to improve outcomes for people rather than places; for individuals and families rather than buildings.” Legendary urbanist Jane Jacobs expressed a similar sentiment: “If planning helps people, they ought to be better off as a result, not worse off.” Yet, urban containment, the principal planning strategy in the most unaffordable markets, is associated with worsened housing affordability. And opting for densification has proven no remedy.

Economists Chang-Tai Hsieh of University of Illinois-Chicago and Enrico Moretti of University of California-Berkeley estimated that housing constraints reduced US economic growth by 36 percent from 1964 to 2009. Housing is not only important to people, but also to the national economy.

Urban containment, the principal planning strategy in the most unaffordable markets, is associated with worsened housing affordability. And opting for densification has proven no remedy.

To achieve affordable housing, the first thing to do is preserve housing affordability in markets where it still exists. New urban containment policies should not be adopted. Moreover, where urban containment exists, it must be reformed to improve affordability.

In California, where the crisis is most severe, Chapman University’s Joel Kotkin and I have proposed a first step to restore housing affordability. The state would establish a Housing Affordability Area (HOA) in interior California, where new housing development would be exempt from urban containment. This should restore the competitive market for land, and stop the escalation of housing prices relative to incomes. In the longer run this should favorably impact the Coast, as households denied the housing they prefer would move to the more affordable HOA. This could reduce the excess of demand over supply on the Coast, moderating costs. California isn’t the only state that would benefit from this proposal, however; HOA is a model that can be replicated in other housing markets dealing with affordability crises.

New thinking is needed to assure a high standard of living for families and other households. Building the housing people prefer on low-cost land on the fringe of urban areas is a prerequisite.