A growing number of social conservatives, including senators Mike Lee, Tim Scott, and Marco Rubio, have begun to explore the possibility of using government policy to directly support childbearing and rearing. In the battles over the Tax Cut and Jobs Act, Marco Rubio in particular fought hard to get an increase in the child tax credit included in the final bill, over the objections of many corporate and libertarian voices in the Republican Party. The difficulty of convincing the Republican elite that families might deserve a break as much as corporations was revealing and disturbing.

Yet many conservatives share a growing concern for plummeting birth rates and an interest in “pro-natal” policies. Are falling birth rates an indictment of our society? Do they come from abrupt cultural change? Are they a sign of deep economic malaise? And, above all, can the government do anything to increase birth rates?

There is abundant academic evidence on pro-natal policymaking: it is expensive, but it does work. If you spend a lot of money on the problem, financial and other incentives for having babies do increase the birth rate, albeit modestly. Some programs may be cheaper than others, in terms of increased birth rates per dollar spent. In general, programs that provide big cash lump sums, that target higher birth parities, and that are not politically divisive will have the biggest effect on births. So, the most cost-effective pro-natal policy would be something like $10,000 checks cut to all parents having their third or higher parity child, assuming you could get bipartisan support for such a policy.

These programs are expensive, and, again, their effects aren’t huge. It would cost an enormous sum to reverse the recent decline in American fertility just using cash incentives. But it’s at least something that can be done.

Start your day with Public Discourse

Sign up and get our daily essays sent straight to your inbox.Does Government Assistance Inevitably Undermine Family Formation?

However, some conservatives worry that this “something” may not be worth doing. Their concern is that incentives for childbearing, which might pejoratively be called “family welfare,” might actually accelerate family collapse. Birth rates were higher 100 years ago, after all, when public assistance was far less generous!

This concern is grounded in a basically correct claim: that many aspects of the welfare state have systematically destroyed the vital forms of social capital that are most essential to American family life, especially marriage.

A simple example of how the welfare state damages marriage may suffice. The eligibility cutoff for a single individual to receive Section 8 housing vouchers is around $25,400 in most parts of America for the 2019 fiscal year, according to the Department of Housing and Urban Development (HUD). But the eligibility cutoff for a family with two members to receive those same vouchers is $29,000. This has a massive effect on discouraging marriage. Consider: a low-income man earning $20,000 is receiving Section 8 vouchers and he marries a low-income woman earning $13,000 who is also receiving Section 8 vouchers. Both of them are individually eligible for Section 8 vouchers. Using some plausible estimates of their likely rents based on HUD data, and based on Section 8 benefit calculations, these two people probably receive about $2,000 to $4,000 in Section 8 housing vouchers per year. In other words, Section 8 increases their combined incomes by approximately 10 percent. That’s a huge benefit!

But what happens if these two people get married? Well, their combined income is $33,000: $4,000 more than the cutoff for Section 8 eligibility. They now get zero dollars in aid, because they got married!

For the record, most conservatives—though not all—support this. Conservative preferences for strict enforcement of welfare eligibility have led to states essentially hiring people to wander around low-income areas and check and see if poor people have shacked up, because if a couple is “common law” married, benefits can be yanked. Economic research has shown that strict enforcement of welfare rules sharply reduces low-income marriage rates. Further research has shown that living in a public housing project (which creates similar kinds of marriage disincentives) increases odds of single motherhood for young black women. The Earned Income Tax Credit, the signature conservative work-encouraging, family-supporting policy, also contains a large marriage disincentive.

Costing out all of these marriage penalties is tricky. But by my calculations, making just the EITC marriage-neutral at current levels of generosity for singles would cost more than $200 billion per year. Fixing the penalties against working-class married people baked into dozens of other programs would be expensive too. Total costs could rise to $500 billion per year, or more.

But, in fact, those costs are already being paid! The difference is, right now, instead of taxpayers footing the bill to treat working-class married people fairly, these costs are “paid” by working class people who are pushed out of marriage and into single parenthood by bad policies.

In other words, we can see that policies related to public assistance do in fact damage vital social institutions like marriage. But the problem is not the public assistance itself: the problem is that our society has decided to provide guaranteed financial support only to single people. It is blindingly obvious as a simple problem of arithmetic that if you design programs that do not double income thresholds when beneficiaries get married, many beneficiaries will lose benefits, and thus marriage among beneficiaries will be discouraged.

Fixing the Incentives

These kinds of marriage discouragements are mostly accidental. But some attacks on the family are intentional.

The best example of this comes from the United Kingdom. In 1976, the UK instituted a family allowance program to support childbearing. It was worth £1 per month for a married person’s first child, and £1.50 for latter children. But single parents got an extra bonus! Single parents got an extra £0.50 per child! By 1979, single parents got £6.50 per kid, but married parents got just £4. This gap persisted until the single parent bonus was removed in 1999.

However, during the 1990s, the UK also decided to give larger benefits for first children and smaller benefits for latter children. As will surprise nobody, firstborn children are more likely to be born to unmarried moms: women are, by definition, younger when they have their first child rather than their second or third. Thus, the UK explicitly gave extra benefits for unmarried parents until 1999, and even since then, the child allowance continues to have an implicit bias in per-child generosity toward unmarried parents.

The justification for this kind of policy is easy to understand: single moms need more help, and first children have a lot of up-front costs. So, from a certain point of view, it makes sense for society to support single parents and first-time parents more.

But when you consider the incentives this creates, it’s absolutely bonkers. It’s literally paying people extra not to get married. It’s a subsidy for broken homes, and a statement that latter-born children are less valued by society.

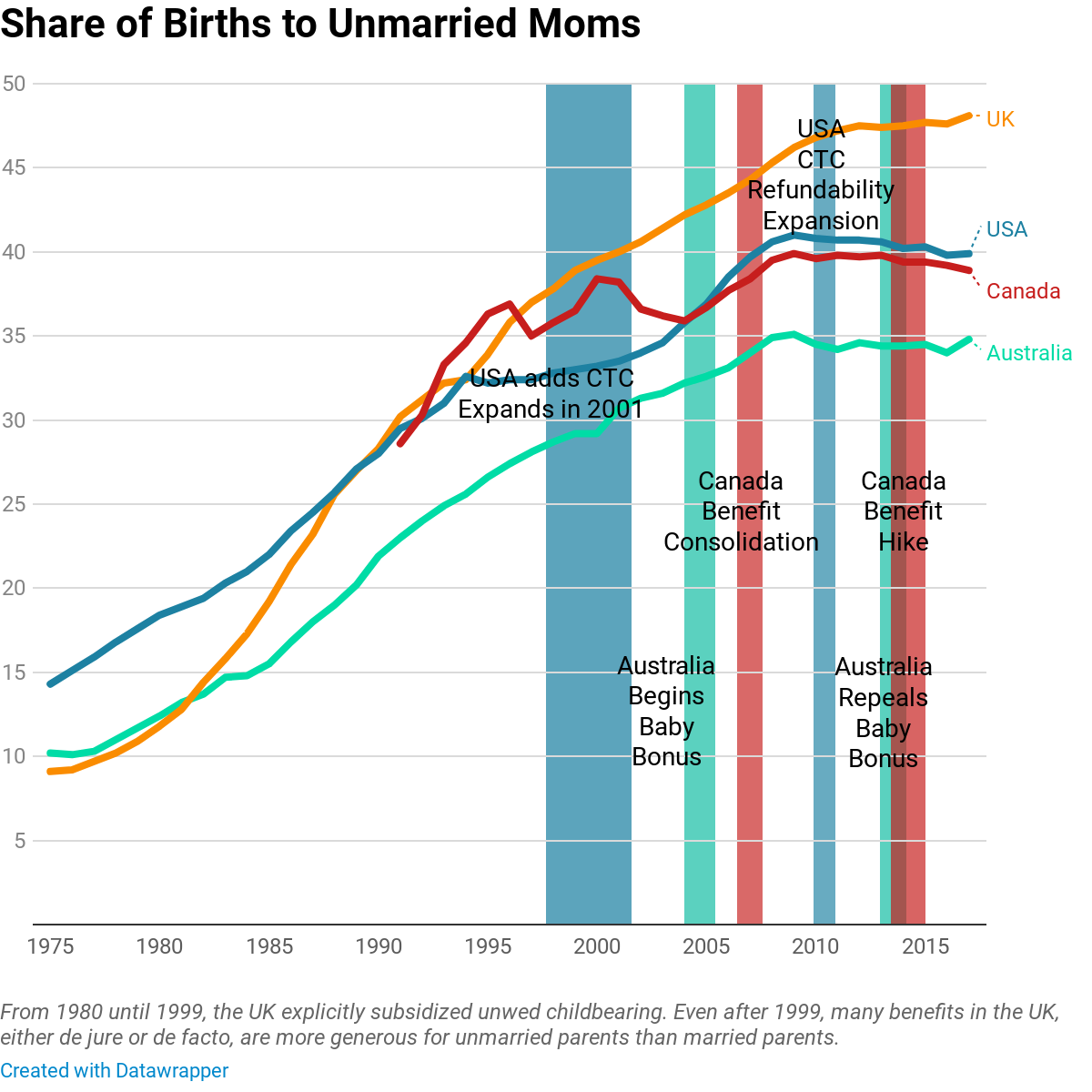

In recent research for the Institute for Family Studies, I compared child allowance policy histories in the United States, the United Kingdom, Australia, and Canada, as well as the share of children born out of wedlock. I found that the UK had the lowest share of unmarried childbirth in 1975, but by the late 1990s, it had the highest. This startling explosion in unmarried childbirth is probably at least in part due to the fact that the UK explicitly subsidized unmarried childbirth. You get what you pay for.

Meanwhile, the country that had the biggest and most successful pro-natal policy was Australia. From the early 2000s until the mid-2010s, Australia provided a Baby Bonus: a big cash benefit to parents for each baby they had. The goal was to increase birth rates. Academic research has shown that it really, really, really, really, really, really worked. And as you can see from the graph, Australia’s trend in unmarried births was about the same in that period as the trend in Canada or the United States.

When you don’t punish people for being married or reward them for being unmarried, but just provide simple, flat benefits to support family life, it turns out that . . . public assistance supports family life! The negative effects of most welfare programs on family life can largely be traced to specific program features that penalize marriage, not to some generalized and extremely philosophical link between government benefits and family-mindedness.

Conservatives Shouldn’t Fear Pro-Natal Policymaking

Many conservatives are looking around at America today and seeing a society where marriage is in retreat, fertility is plummeting, and the viability of the natural family as a socially normative unit is under threat. The panaceas of libertarians—that we can fix this problem by just cutting corporate taxes a little more or tightening up eligibility rules for another program—ring hollow. As costly as it may be, many conservatives are beginning to recognize that pro-natal policymaking may be part of a solution for a more grounded, worker- and family-friendly kind of conservatism.

There are legitimate concerns that expanding government in this way could make the problem worse; historically, welfare programs often have damaged family life. But the plain fact of the matter is that it’s not housing vouchers or wage supplements that discourage healthy family life: it’s the overt choice of policymakers to write eligibility rules in such a way as to punish working-class people for getting married. If pro-natal policy can avoid this pitfall and provide people with simple benefits that don’t punish people for the good choice to get married and have a family, then there’s every reason to expect they could boost birth and marriage rates—and no reason to see them as a threat to the family.